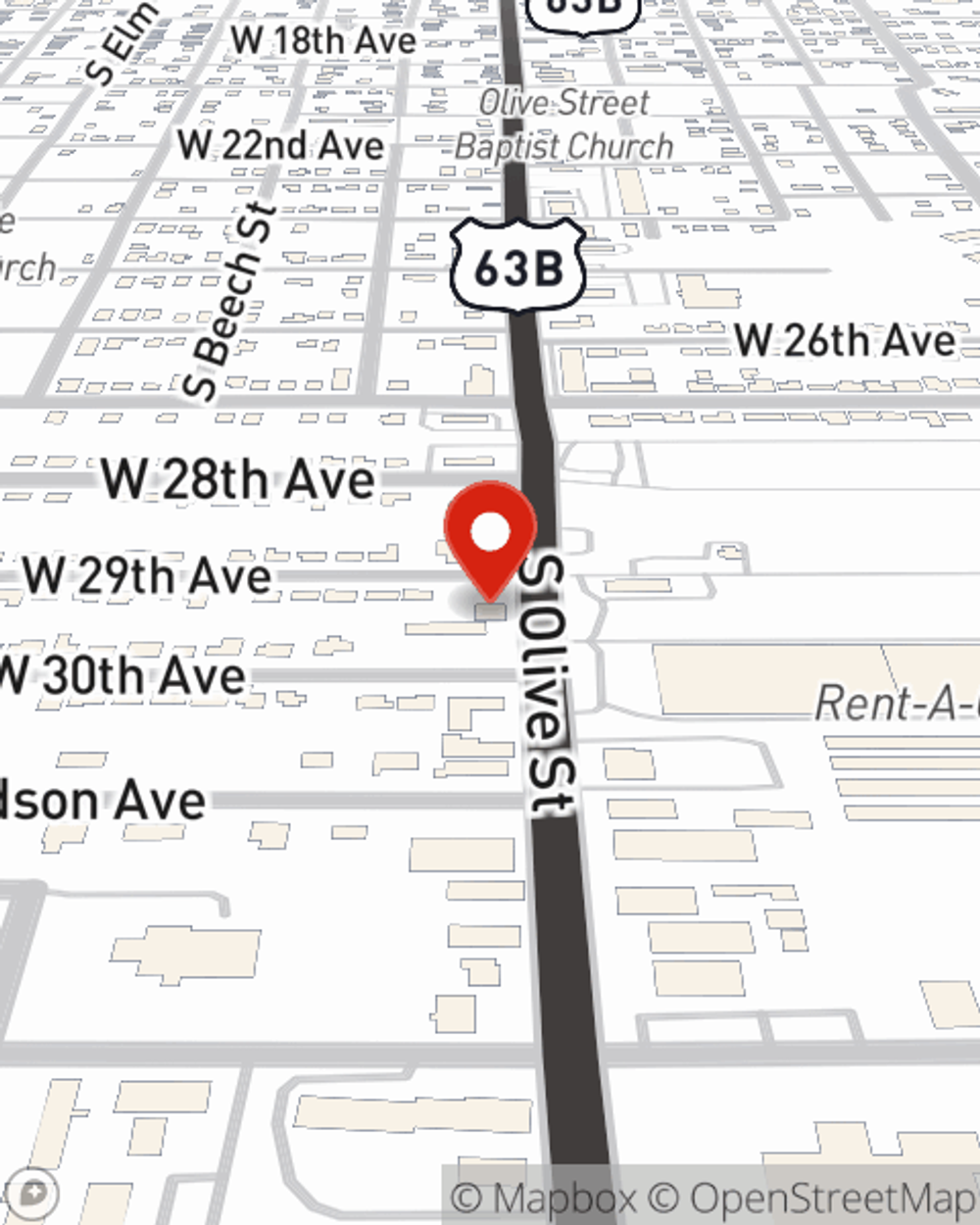

Renters Insurance in and around Pine Bluff

Get renters insurance in Pine Bluff

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Pine Bluff

- White Hall

- Jefferson County

- Rison

- Cleveland County

- Star City

- Lincoln County

- Little Rock

- Pulaski County

- Gould

- Dumas

- McGehee

- Jefferson

- Redfield

Calling All Pine Bluff Renters!

There's a lot to think about when it comes to renting a home - price, parking options, internet access, condo or apartment? And on top of all that, insurance. State Farm can help you make insurance decisions easy.

Get renters insurance in Pine Bluff

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

When the unexpected break-in happens to your rented property or apartment, often it affects your personal belongings, such as a coffee maker, a tablet or a set of golf clubs. That's where your renters insurance comes in. State Farm agent Kevin Bonnette is dedicated to help you understand your coverage options so that you can protect yourself from the unexpected.

It's never a bad idea to be prepared. Contact State Farm agent Kevin Bonnette for help getting started on options for your policy for your rented property.

Have More Questions About Renters Insurance?

Call Kevin at (870) 535-2233 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Kevin Bonnette

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.